Foreign National Tax Information

Tax Info for Nonresident Alien Scholarship Recipients

Tax Information for Nonresident Alien Scholarship Recipients

To comply with tax rules and regulations, Valdosta State University must charge all nonresident alien students, who are not exempt by a tax treaty, a tax on the amount of scholarship they receive over tuition and fees. This amount is considered taxable income in the United States.

Financial Services is notified of nonresident alien students who receive scholarships. This information is used in conjunction with the charges on the student’s account to determine if there is income to tax.

Glacier is an independent system VSU utilizes to determine if a student qualifies for a tax treaty. All students with taxable income will receive an invitation from Glacier to complete tax a record. The Glacier tax record will not be complete until all forms are signed and required documents are received.

If there are applicable tax treaty exemptions, and the student meets the requirements set forth in the treaty, the student will be required to complete Form W-8BEN. These forms must include the student’s social security number (or ITIN if a SSN is denied).

If there are no applicable tax treaty exemptions, or if the student does not meet the requirements of the tax treaty, the amount of scholarship received over tuition and fees will be taxed at a rate of 14%. This is a reduced rate and requires the student be present in the U.S. under an F, J, M or Q visa type. Financial Services must receive a copy of the student’s visa and social security card as well as their permanent address in the home country.

The following are requirements for scholarship recipients:

Scholarship Recipients:

(Submit to Awarding Department/Financial Services)

- Signed Tax Summary Report from Glacier

- Copies of all immigration documents – Passport, Visa, I-94, I-20, etc.

- Copy of Social Security Card or ITIN

- Form W-8BEN

- Other forms required by Awarding Department

After the close of a calendar year, any student who has taxable income will receive a 1042-S form from VSU which is used by the student to file an annual tax return with the Internal Revenue Service.

If you have any questions, please email us at paymentinfo@valdosta.edu or call (229) 333-5708 for assistance.

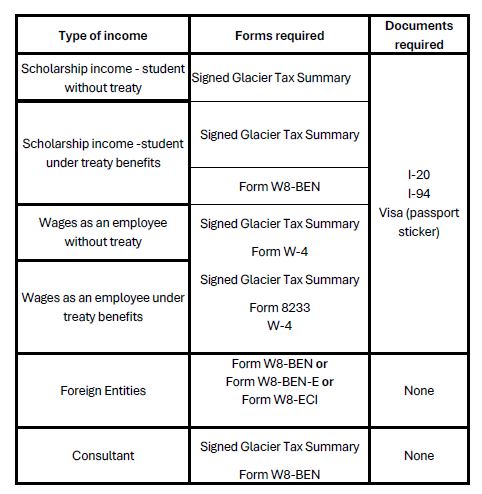

Summary of required forms and documents by income type:

Payments to nonresident aliens are generally subject to income tax withholding of 30% unless the foreign national is eligible to receive a tax treaty benefit. Before inviting or otherwise agreeing to pay a non-U.S. citizen, departments must ensure that the individual is or will be present in the U.S. under a VISA classification that allows them to legally receive payment.

Frequently Asked Questions

- The United States must have a treaty with payee/recipient’s country of residence.

- A taxpayer identification number is required to claim treaty benefits.

- All required forms must be on file with the Financial Services office.

https://www.irs.gov/individuals/international-taxpayers/taxpayer-identification-numbers-tin

For students receiving scholarship funds, you may visit the Office of International Program for assistance.

- Yes – if income was earned in the United States.

- If you have earned income from VSU, you will receive forms to report income to the Internal Revenue Service.

- U.S. Tax Guide for Aliens -https://www.irs.gov/pub/irs-pdf/p519.pdf

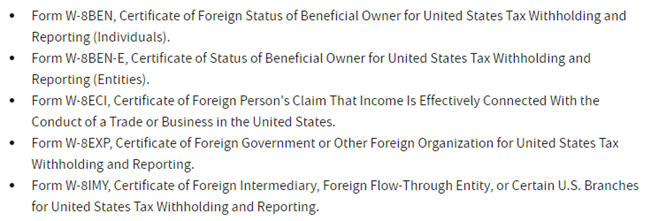

- Instructions for W8-BEN - https://www.irs.gov/pub/irs-pdf/iw8ben.pdf

- Taxation of Nonresident aliens - https://www.irs.gov/individuals/international-taxpayers/taxation-of-nonresident-aliens

Student Financial Services

-

1205 N. Patterson St.

University Center

Entrance # 6 & 7

Valdosta, GA 31698 -

Mailing Address

1500 N. Patterson St.

Valdosta, GA 31698 - Phone: 229.333.5725

- Fax: 229.259.2051

M-TH 8am - 5PM pm and Friday 8am-2:30pm.